NWP Monthly Digest | September 2023

Time Is on My Side

Last month, I hit a significant milestone: the big 4-0. Often portrayed as a pivotal moment in one's life—a juncture where hard-earned wisdom meets fresh opportunities. This milestone prompted me to reflect on my triumphs, failures, desires, and the critical life lessons I've amassed. So, am I proud of the person staring back at me in the mirror?

I'm fortunate to have years that have imbued me with invaluable insights and catalyzed my professional and personal evolution. But let's be real; I also carry my share of regrets. Bill Perkins' book "Die With Zero" posits that a fulfilling life is about optimizing each stage for maximum enjoyment. While I don’t subscribe to every tenet he espouses, the core message disrupts conventional wisdom in a compelling way.

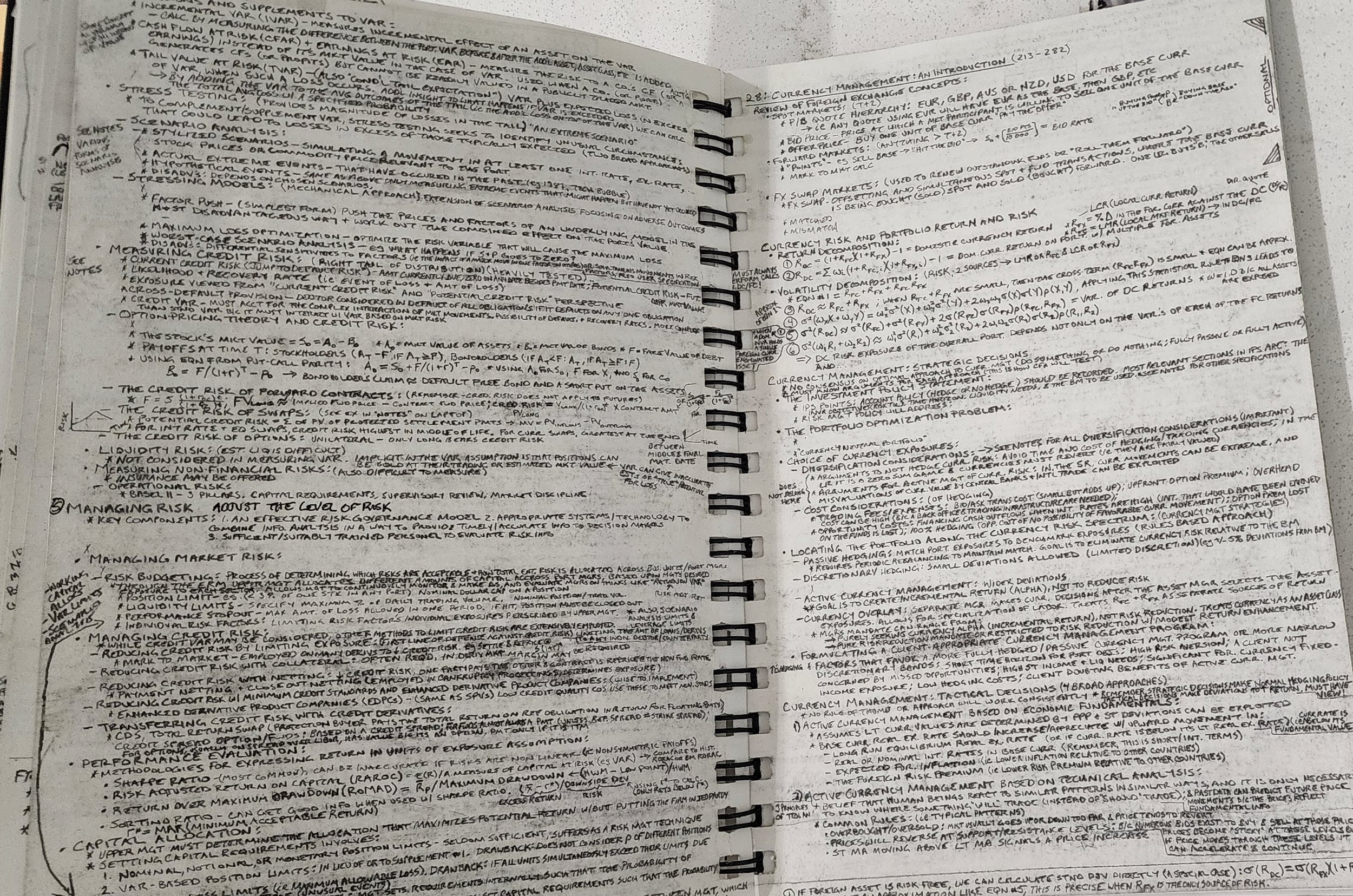

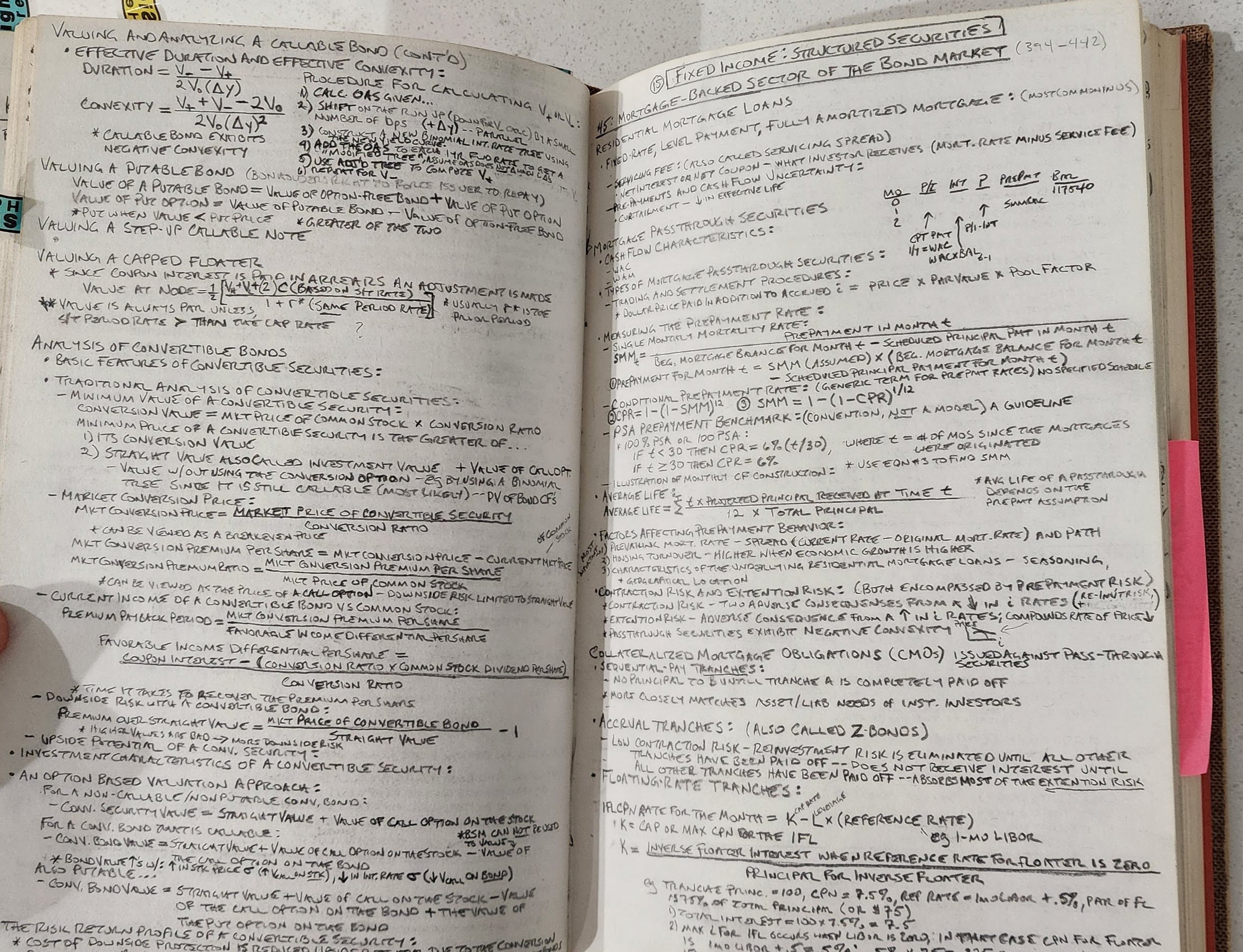

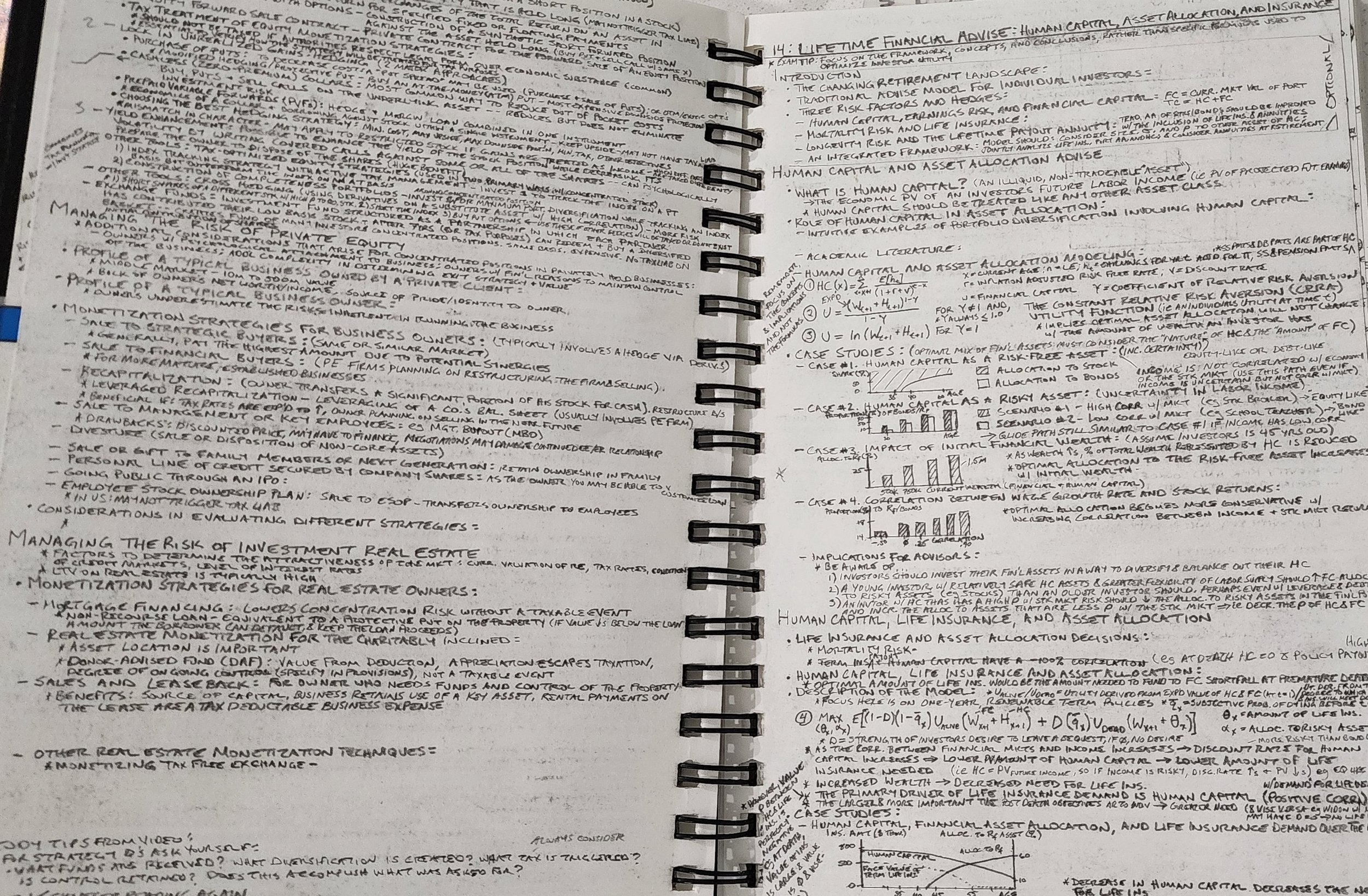

In my late 20s—often glorified as the "Golden Years"—I was fixated on professional success, buried in study guides for the CFA charter. When I embarked on this taxing endeavor, the CFA Institute provided cards to notify loved ones about our impending absence. One poignant card depicted a lone dog on an empty street with the caption, "Your dog has to walk himself now." I was vaguely aware of the grueling odds—only a 35% pass rate and I heard whispers that only one in eight candidates successfully completed all three exams. Yet, the sheer magnitude of the commitment didn't fully register until I had earned my CFA charter.

Though my circle celebrated this hard-fought accomplishment, the relational toll was inescapable. Close friends became mere friends, friends turned into acquaintances, my girlfriend morphed into a chapter from my past, and my family? I hadn't savored quality moments with them in over three years. Bill Perkins contends that missed life experiences are irreplaceable. Reflecting on missed vacations, rafting adventures, and countless other experiences, I realize Mr. Perkins hit the nail on the head.

But Time Is on My Side

Mistakes? We all make them. The key is to evolve through introspection. Even wisdom-laden figures like Confucius and dynamic entrepreneurs like Elon Musk weren’t born sage—they learned, sometimes the hard way. Don’t believe me? Just look at his Twitter acquisition.

"He who makes no mistakes makes notlhing at all." - Confucius

My years on this earth have equipped me with a clearer sense of purpose. As I enter my 40s, time is on my side - yes it is! I look forward to a long life, enriched by the lessons I've already learned. Time spent with my amazing wife, my wonderful son, and our soon-to-arrive baby due in October, never feels like enough. I plan to cherish every invaluable moment with my family, friends, and those I love. When my time comes, I'll take comfort in knowing I made beautiful memories doing what I love with the people I love.

I Hope Time Is on Your Side as Well

Time has given you wisdom, perspective, experiences, and opportunities. It's also a key contributor to your financial well-being. Both time and money are finite resources that you can either capitalize on or squander, and the management of one often directly influences the other.

Every hour squandered is a missed chance to propel your life forward, whether you're focusing on personal aspirations like quality time with family or planning for a secure retirement. Hours that could have been devoted to career development and boosting your human capital—essentially your future earnings potential—are irreplaceable. The same logic applies to money; each dollar frivolously spent could have been either saved or invested.

Investing early in life can offer remarkable long-term rewards, largely due to the magic of compound interest. The advantage is amplified when you have the luxury of a lengthy investment horizon (i.e., the period until you'll need to tap into your portfolio), significantly boosting your chances of positive returns. To drive home this point, consider the U.S. stock market, as represented by the S&P 500. While its performance may fluctuate from year to year, it has never posted a loss over any 30-year span, consistently delivering an average annual return of around 10%!

Embracing a strategy that optimizes the use of your resources can profoundly elevate your financial plan, laying a solid foundation for financial freedom. This freedom allows you to allocate more time to passions, hobbies, and meaningful relationships. Whether your goal is early retirement or simply relishing life's joys, this approach offers a pathway to enhance both your financial portfolio and your personal experiences. It's a delicate balance—exercise caution and refrain from repeating my mistakes, which included enduring arduous personal sacrifices during my early years. Depending on your financial objectives, you might also aspire to pass wealth down to future generations, building a lasting legacy. How you've allocated your time can leave a more enduring impact than you might think.

Time Is Your Greatest Asset!

Time and wealth are two sides of the same coin, each influencing and enhancing the other. All the time or money in the world doesn’t guarantee a better life. However, optimizing your time to generate wealth can provide you with financial flexibility—a powerful tool for living a fulfilling life. Jerry Ragovoy wrote the classic song "Time Is On My Side," and the sentiment behind those words rings truer than ever. Time is on your side, serving as your greatest asset. Utilize it wisely, and you can live rich, instead of just being wealthy.

A Favor to Ask

The recent SEC revision to the testimonial rule has significantly elevated the importance of client reviews, allowing financial advisors to more effectively showcase their value proposition. At Noble Wealth Partners, we are committed to crafting tailored strategies that align with our clients' objectives. Your direct experience with our services is invaluable to us. If you could take a moment to share your insights and review our business on Google, your feedback would be highly appreciated.

Noble Wealth Pro Tip of the Month

Social Security Benefits Will Go Up Next Year, but Perhaps Not Enough to Offset Rising Costs

If inflation continues its current upward trajectory, experts and nonprofits forecast a roughly 3% increase in monthly checks for recipients in 2024. This follows an 8.7% cost-of-living adjustment (COLA) in 2023, propelled by surging inflation rates. While the projected 3% increase surpasses the 2.6% average COLA over the past two decades, it may still fall short of offsetting the rising living costs for many. To ensure financial stability, it's crucial to assess the health of your retirement plan. For those facing the risk of depleting their funds, a thorough review of spending habits and necessary adjustments to financial strategies could be prudent.

Consider a Higher Mortgage Rate

For prospective homebuyers, when mortgage rates exceed 7.2%, it becomes advisable to investigate alternatives such as accepting a slightly higher mortgage rate to reduce closing costs or utilizing a lender credit to mitigate these charges. This approach is especially advantageous for individuals with short-term housing goals, as it optimizes financial benefits without locking into long-term obligations.

Prepare if Your Student Loans Are Coming Due

As student loan payments resume after a three-year pause, it's crucial to be informed and prepared. Interest will start accruing on existing loans from September 1st, and the first payments will be due in October. Notably, the newly introduced Saving on a Valuable Education (SAVE) plan is taking the place of the former Revised Pay as You Earn (REPAYE) plan. This new plan aims to lower monthly payments for borrowers while expediting the repayment process. Taking advantage of the SAVE plan sooner rather than later can lead to both immediate and long-term financial advantages.

By taking these steps, you can better navigate the complexities of student loan repayment and avoid a financial misstep:

Identify Your Lender: Contact your loan servicer to get the details you need.

Know Your Obligations: Familiarize yourself with the amounts due and their respective deadlines.

Explore Repayment Plans: Investigate various repayment options to find one that suits your financial situation.

Mental Preparation: Brace yourself emotionally for the resumption of payments, as this is a significant financial commitment.

Fun Facts of the Month

One for Jeff: Baseball unicorn Shohei Ohtani’s 2023 season on the mound was cut short last week when the Angels announced he had a torn ligament. At the time of the injury, Ohtani was leading the league in home runs and OPS as a hitter, and he had a league-leading batting average against of just .184 as a starting pitcher (MLB.com).

How much? For buyers putting 20% down, monthly payments to cover the median cost of a home in the US are the equivalent of 70.3 hours of salary. That’s nearly double the 37.9 hours from May 2020, and only two other months (October and November 2022) in the last thirty years have seen housing at less affordable levels (Bespoke).

A quick tip: One way to help prevent identity theft is to “freeze” your credit so that no one can open new accounts or take loans in your name (unless you unlock it with a password). While it’s free and available to everyone, when LendingTree analyzed the anonymized data in 2022, only 9.9% of consumers nationally had full credit freezes (LendingTree).

Now what? The Conference Board’s index of Leading Indicators declined for the 16th straight month in July, which ranks as the third longest streak of declines since 1960 and the longest since the 24-month streak leading up to and during the global financial crisis in 2008. Besides that, the only streak longer than the current one was the 22-month streak ending in March 1975 (Conference Board).

Fraud alert: Direct reports of identity theft and financial fraud to the Federal Trade Commission (FTC) totaled 2.4 million in 2022, which was down from 2.9 million in 2021. Despite the decline, the total reported loss to consumers from these frauds and scams increased 30% to $8.8 billion. Of that, $3.8 billion was due to "investment scams," which more than doubled from the $1.8 billion reported in 2021 (FTC).

Falling short: Many advisors recommend that by the time you turn 50, you should have around six times your annual salary saved for retirement. According to an analysis by Fidelity, Americans aged 50 to 59 have an average 401(k) balance of just $190K, and the median balance is just $57K (Fidelity).

Stock outperformance: The outperformance of stocks versus bonds in the post-COVID era has reached a multi-decade extreme. In the past 41 months since the COVID lows in March 2020, the S&P 500 has gained 80% on a total return basis compared to an 11% decline in the Bloomberg U.S. Aggregate Bond Index. That gap is over 90%, and the widest for any 41-month period since March 2000. Although the S&P 500 trades for an elevated 21.4 times earnings, the premium valuation is top-end-loaded. While the ten largest companies in the index have a median price/earnings multiple of 27.5, the median multiple of the 490 remaining companies is more than ten points lower at 17.0 times earnings (Bespoke).

Decreased pay: In a July survey of 2,000 employers by job search website ZipRecruiter, nearly half said they had reduced pay for recent job openings. In a separate ZipRecruiter survey of recently hired workers, 35% said they took a pay cut at their new job, which was up five percentage points from the prior quarter (ZipRecruiter).

Slowing inflation: In last month’s inflation (CPI) report, prices rose 3.2%, and Core CPI, which excludes food and fuel, rose 4.7%. While those are well above the Fed’s 2% target, shelter (i.e., housing) costs made up 90% of the CPI index. CPI without shelter only rose 1% on a year-on-year basis - implying the Fed may have accomplished its goal.

Ivy league graduates' influence: Researchers examined the eight Ivy League colleges plus University of Chicago, Duke, MIT, and Stanford and found that while less than 1% of Americans attended, their graduates make up one-quarter of U.S. Senators, half of all Rhodes scholars, and three-fourths of the Supreme Court justices appointed in the past 50 years.

Tuition trends: Over 30 years through 2022-2023, tuition and fees for private nonprofit four-year colleges rose 80%, to an average of $39,400. Public four-year college in-state tuition and fees more than doubled, to an average $10,940. Private college tuition rose 3.5% over 2021-22, before inflation adjustments (The College Board).

Rising university revenues: In a report by the Wall Street Journal, the median university got double the revenue from undergraduate and graduate tuition and fees than it did 20 years ago. Accounting for enrollment gains, that works out to a 64% price increase for the average student (WSJ).

Social Security adjustment: The Senior Citizens League’s projected Social Security cost-of-living adjustment for 2024 remains unchanged from last month’s estimate of 3%. The average monthly benefit of $1,789 would increase by $53.70. The Social Security Administration will set 2024’s adjustment in October.

S&P 500 overbought streak: Last Thursday (7/27), the S&P 500 closed at short-term overbought levels (more than one standard deviation above the 50-day moving average) for the 42nd straight day, a streak that started the Friday before Memorial Day. The current streak is the longest since September 2020 (45 days) and the 24th streak of 40 or more trading days in the last 70 years. In the 24 prior periods since 1953 that the S&P 500 closed at short-term overbought levels (more than one standard deviation above the 50-day moving average) for 40 days in a row, its median performance over

What We’re Reading

Integrated circuits, commonly known as silicon chips or semiconductors, are pivotal to both national economies and contemporary military infrastructures. Chris Miller's analysis offers historical perspective on the vital role of semiconductors. The prospect of conflict with China could be shaped by its efforts to reduce dependence on imported chips and technology. This issue has gained prominence due to recent legislation from the Biden administration, which seeks to limit the export of this essential technology to China.

In the digital era, the advent of technology and social media amplifies both the challenges and the significance of free speech. While the concept of free speech has been a cornerstone of democratic societies since the days of ancient Athens, it has also faced suppression from various religious doctrines and authoritarian regimes, such as the Soviet Union and Nazi Germany. This book offers an exploration of free speech, charting its historical evolution and philosophical foundations worldwide. It delves into the intricate relationship between free speech and other societal imperatives, such as security and equality, providing a nuanced understanding of how different cultures and legal systems approach this pivotal human right.