NWP Monthly Digest | January 2023

Stocks closed out 2022 with a whimper as major indexes suffered their worst year since 2008. Is Santa real? The stock market doesn’t seem to think so. The infamous “Santa Claus Rally” never came, but that didn’t stop the Arctic temperatures from freezing Denver. On December 22nd, Denver temperatures were the coldest since December 22nd, 1990 - exactly 32 years ago! If you’re like me, you’re ready for some new storylines beyond inflation, the Federal Reserve Board (the Fed), the crypto collapse, Elon Musk, and let’s not forget Donald Trump. The World Cup was a nice distraction, but it is now over. A big congrats to Lionel Messi and Argentina for their World Cup victory.

Sure - 2022 was Messi, likely a year investors would rather forget. Still, I’m going to share two things that surprised me in 2022 - unfortunately, one of them signals a zero percent chance the economy is left unscathed. There are two developments worth keeping an eye on as we head into 2023 and three reasons to head into the new year with a smile.

Two Things That Surprised Me This Year

1) The Failure of Diversified Portfolios

The quintessential diversified portfolio is 60% stocks and 40% bonds. The total return of this portfolio was around negative 16% in 2022 (using the S&P 500 as the stock index and the Bloomberg Barclays Index for bonds). This will be the worst year for the diversified model portfolio since 1937!

Heading into the year, stocks and bonds were both overvalued, and an adjustment was warranted, but I did not expect the unprecedented collapse of all asset classes in 2022.

2) The Speed of Rate Hikes by the Federal Reserve

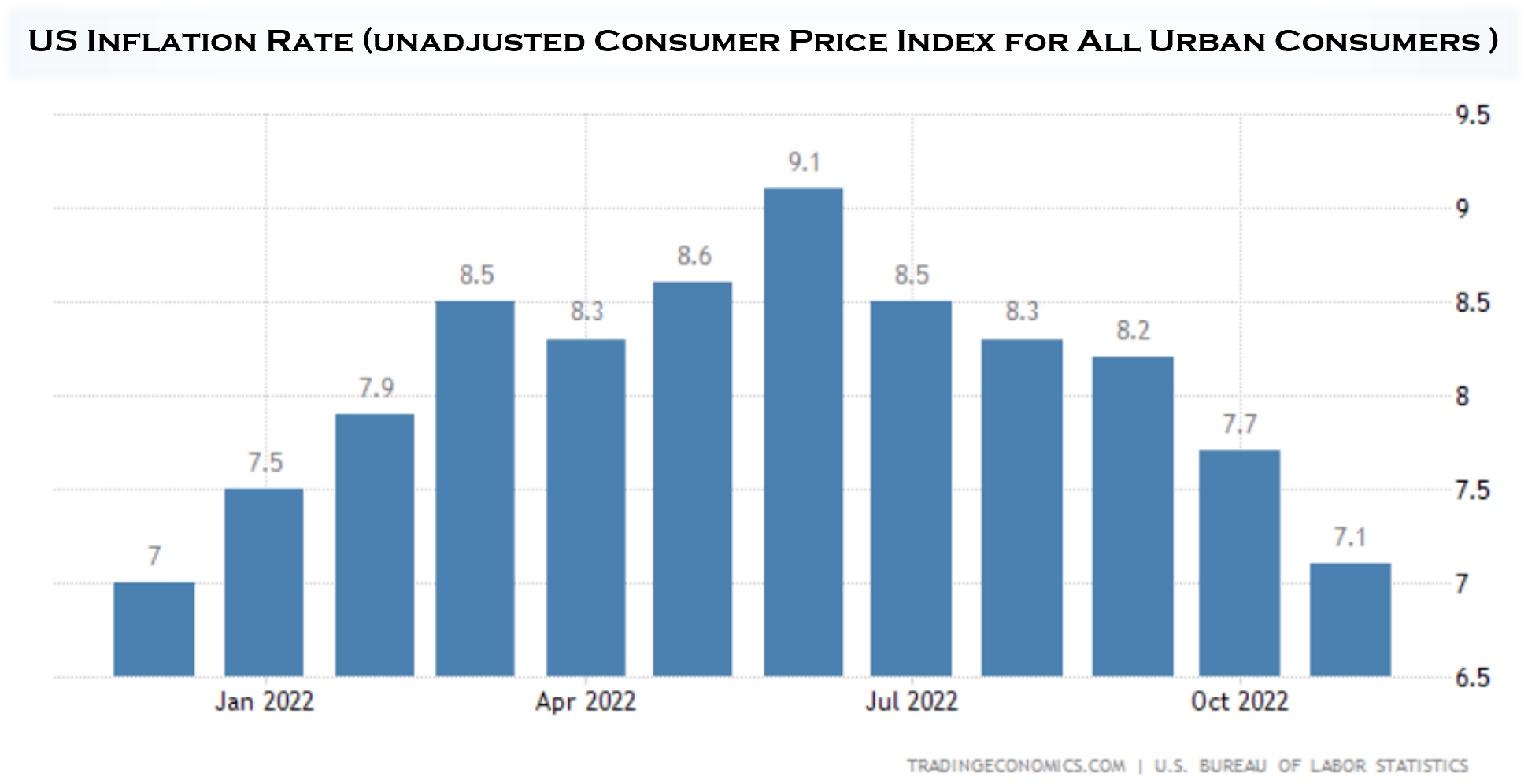

In January of 2022, the Labor Department released the CPI (consumer price index) report showing U.S. inflation hit 7% in December of 2021, and the Fed had yet to lift rates this cycle. That month, in congressional testimony, Fed Chairman Jerome Powell, said he was optimistic supply-chain issues would ease this year and help bring inflation down. Swing and a miss…

When the unemployment rate dropped below 5% in the middle of 2021, it was time to return to normal policy, and the emergency measures enacted during the pandemic were no longer needed. I sympathize with Jerome Powell, the Fed Chair, as he did not want to halt this expansion if inflation was indeed transitory. And he may have had an argument since economists have been consistently wrong about the threat of inflation for the past 30 years.

Either way, the Russian invasion of Ukraine exacerbated pricing pressures and crushed any hopes of controlling inflation through monetary policy. Now, the Fed was behind the eight-ball, and putting a lid on inflation without inducing a recession would be a Cinderella story.

In November, exorbitant inflation concerns abated, and investors saw light at the end of the tunnel. Several indicators implied a significant collapse in the inflation readings, and the Fed may have accomplished its goal. Would we see a “Santa Claus Rally” in 2022? The Santa Claus Rally is the tendency for stocks to rise during the last five trading days to wrap up the year, and the first two trading days of the new year. In fact, the stock market is higher 78.9% of the time during this seven-day stretch - higher than any other seven-day period during the year (LPL Research).

Unfortunately, the Fed slammed the door on any hopes of a “Santa Claus Rally.” Investors balked when the Fed adjusted their expectations of a higher terminal Fed Funds Rate in the so-called “Dot Plot” - and rightfully so. Inflation is rapidly falling, and additional hikes may be unnecessary. Remember, Fed policy works with a 12-18 month lag.

Zero Percent Chance the Fed Leaves the Economy Unscathed

If the Fed was slow to react as inflation rose, should we be surprised to see their reluctance to tap the brakes as inflation falls? Probably not. Hence, the reason nine of the last 12 hiking cycles ended with the Fed tipping the economy into a recession. Forget about a soft landing. With CPI at levels not seen since the 70s, Fed will almost certainly tip us into a recession.

The economic equivalent of a canary in the coal mine occurs when 10-year Treasury Bonds yield less than 2-year Treasury Bonds. Also known as an inversion of the yield curve. Currently, this spread is the largest since the 1980s!

Forecasting a recession is usually a difficult feat, but perhaps not this cycle. If we plunge into a recession, this will be the most telegraphed recession ever - even Cardi B presaged the economic downturn.

“When y’all think they going to announce that we going into a recession?” - Cardi B (June 2022)

Two Developments to Monitor This Year

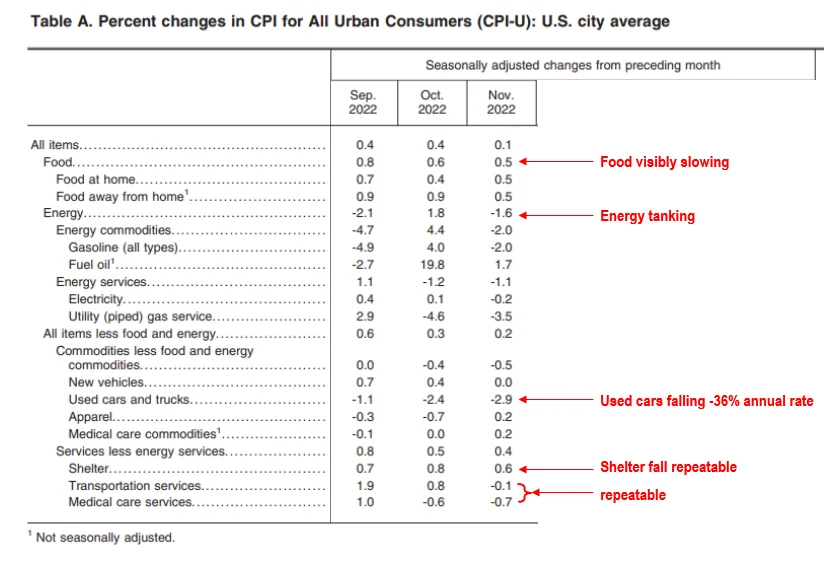

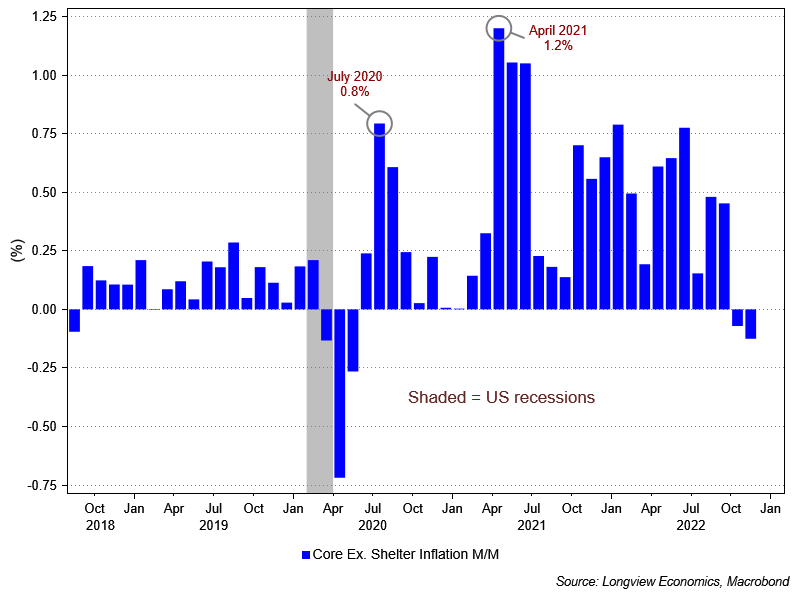

1) Peak Inflation

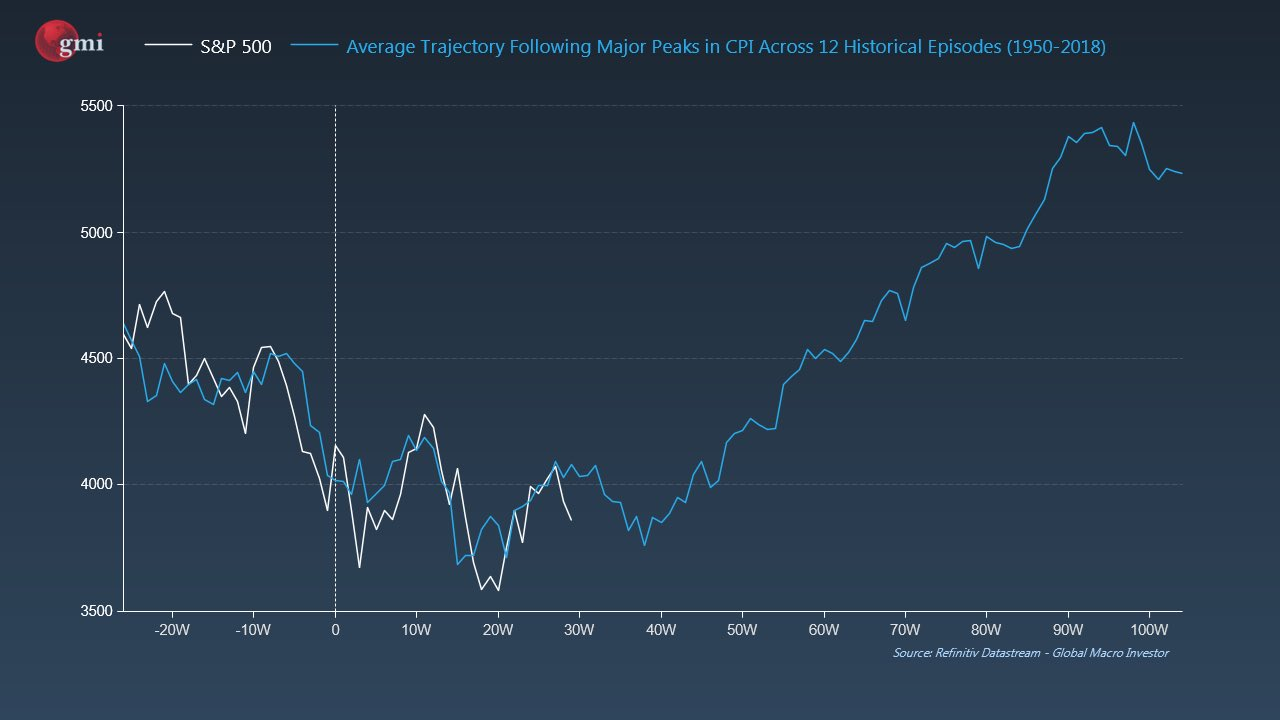

The S&P 500 has historically reached cycle lows around three and a half months after inflation peaks, and the confirmation of a cycle low surfaces with higher lows around ten months after the inflation peak. To date, we are right on trend, and the stock market may have bottomed in October last year.

2) Economic Fundamentals

There’s a good chance we will enter a cyclical recession in 2023. Cyclical recessions coincide with a normal business cycle and are a healthy phenomenon to prevent catastrophic drops in the equity markets. On average, cyclical recessions last 26 months with losses of 30%. In October of 2022, the stock market was down around 25%, so it wouldn’t be a stretch to assert we have already hit the lows for this bear market.

However, if the effect of inflation is already being felt by households, and the labor market turns south, the recession could worsen, and the bear market may wreak additional havoc for investors. This is not my base case, but it is a risk worth watching.

Three reasons to get excited for 2023🎉

1) We Could Be Close to May Have Seen the Bottom

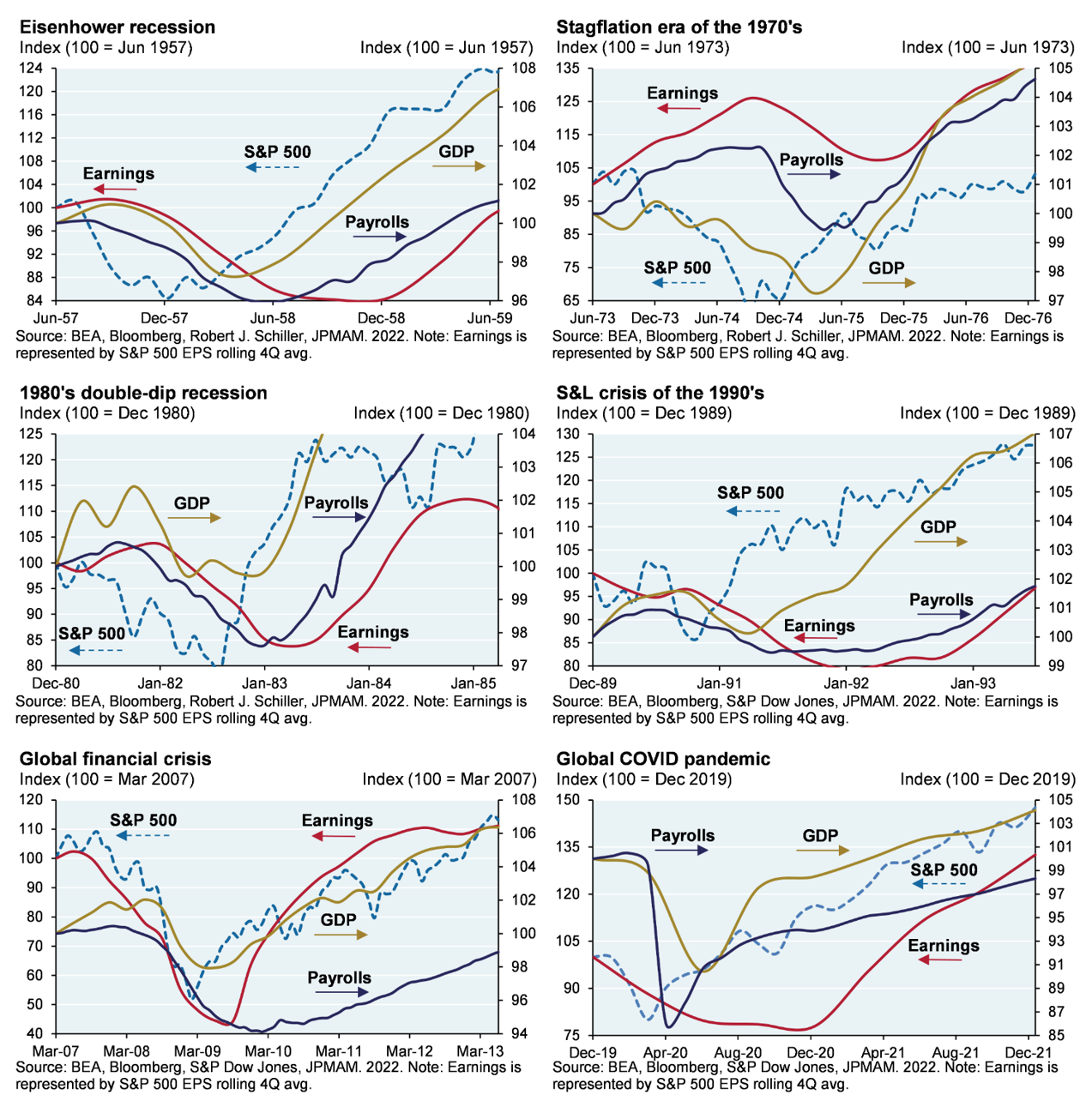

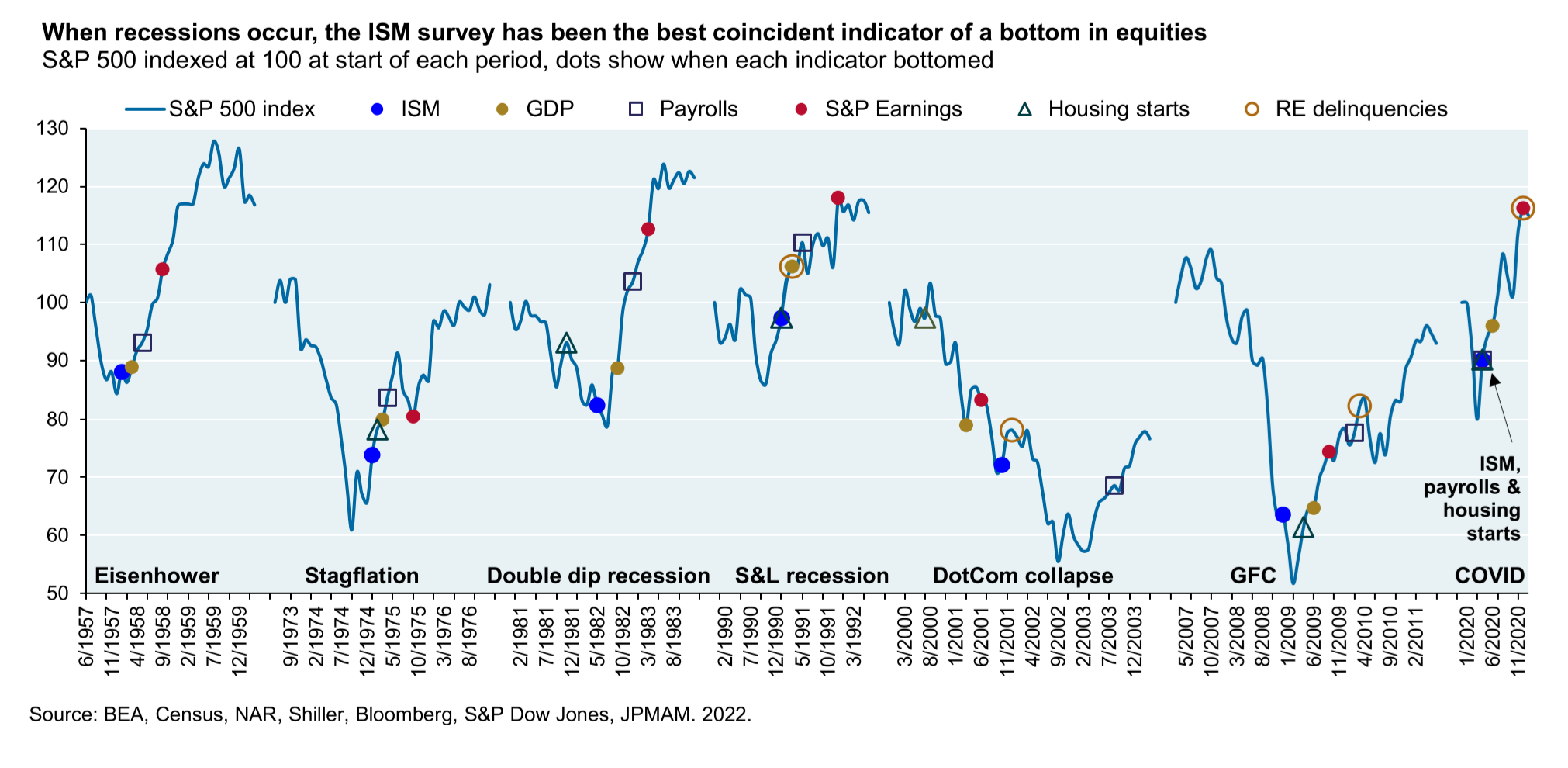

When recessions are not deep or structural, like the Great Depression or the Financial Crisis, the stock market lows tend to coincide with peaks in earnings and payrolls and a trough in the ISM Manufacturing Index.

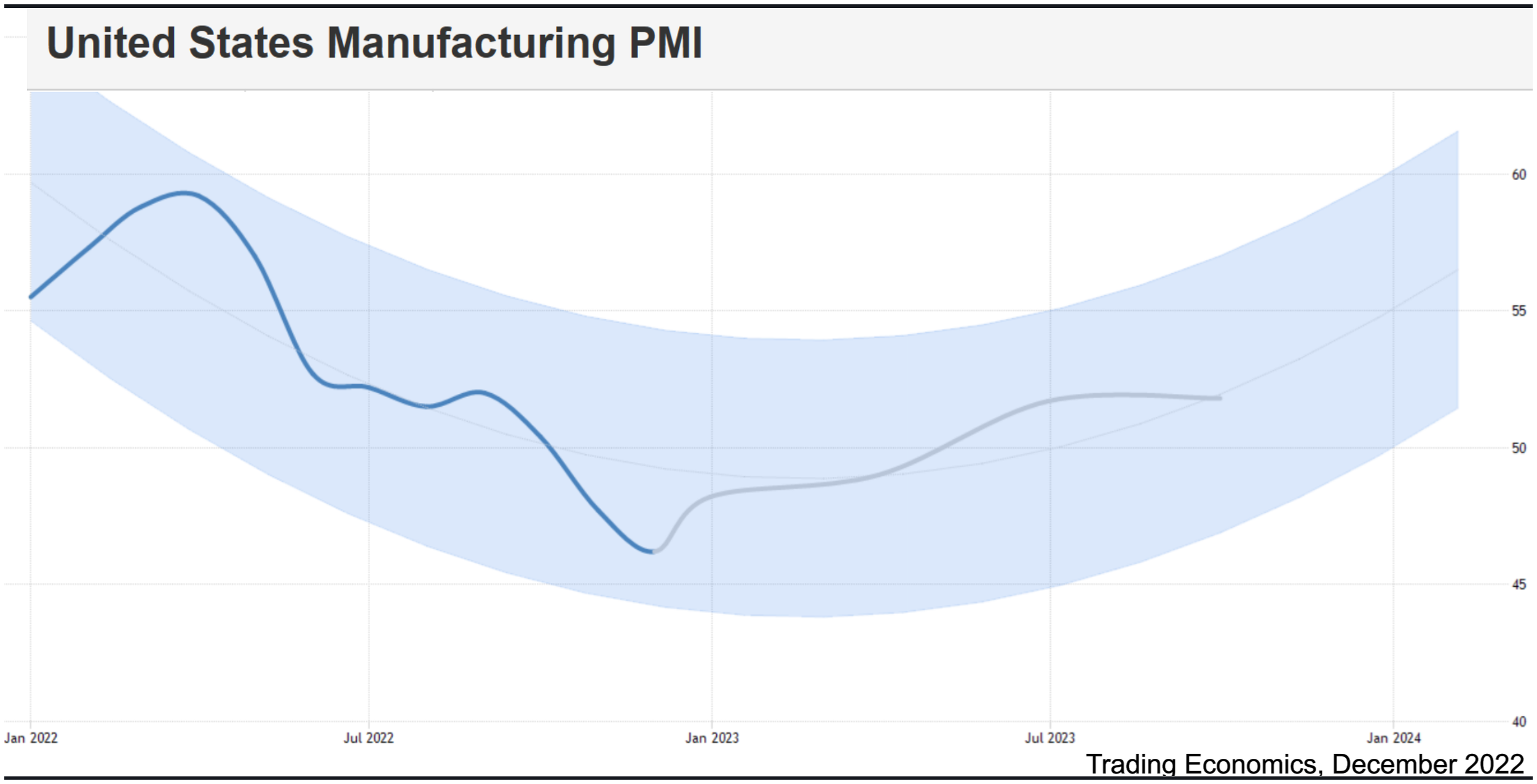

In fact, a trough in the ISM Manufacturing Index is one of the best predictors of a stock market bottom, which usually occurs within two months of the stock market bottom. Estimates for earnings last quarter show signs of topping, payrolls have waned since July, and there are signs the index may bounce in January.

These are constructive developments for the stock market and those with cash on the sidelines should be looking for an opportunity to put that money to work.

2) Constructive Equity Views

It’s rare to see the stock market fall in consecutive years, and if we are near the lows for the stock market, 2023 could be a bright year for investors. More reasonable valuations and bearish sentiment provide investors with a healthy foundation.

3) Bonds on Sale

Heading into 2022, the fundamental backdrop for bonds was appalling. The interest rate on the 10-year U.S. Treasury Bond was only around 1.5%, and approximately 20% of global government debt had negative yields…yikes! Today, the 10-year Treasury Bond has a rate of almost 4%, and many conservative bonds have yields north of 5%. These interest rates are welcomed by investors, and those investors may see additional tailwinds in the form of price appreciation if inflation rates continue to fall.

Noble Wealth Pro Tip of the Month

Together or Separate?

A study reveals that married couples who combine finances are happier, so why don’t more couples do it? According to a survey from CreditCards.com, 43% of couples only have joint accounts, 34% have a mix of joint and separate accounts, and 23% keep their finances entirely separate. While joint finances create accountability, transparency, and trust, allowing couples to accumulate wealth, there are risks work considering. Married couples should be on solid ground, discuss each partner’s money scripts, and know their financial picture. In the event of a divorce, separate accounts are easier to divide. Some partners may bring a history of money trauma (e.g., money scripts) to a relationship, which can impact their ability to grow their nest egg. And finally, debt can throw a curveball in any relationship.

Conquer Status Quo Bias

When entertaining and planning for a new idea or opportunity (e.g., a new job, house, or phase of life), it is common to just keep doing what we are already doing – and when what we are currently doing is working well enough, the emotional ‘cost’ of change often outweighs the potential benefits, even if the new opportunity is truly better. If you already know your current path is irrational, simply looking at the numbers and the logic may be counterproductive.

Envisioning your future self can bring in a new perspective, helping to overcome emotional ambivalence in a non-invasive way.

Lessons from White Lotus

Review your estate plan!

Rich people can (and do) go broke

Do not try to keep up with the Joneses

Fun Facts

WORDLE? In 2022, “Wordle” and “Johnny Depp” were some of the most popular searches on Google.

WANING HOME SALES: Existing home sales dropped 35.4% to an annualized pace of 4.09 million sales, making November the second-slowest month since 2010. It's also the 10th straight month of declining existing-home sales—a record streak.

MOST NEED HELP: A Northwestern Mutual study found that the average retirement savings have dropped 11% from $98,800 last year to $86,869.

THOSE WORKING WITH A FINANCIAL ADVISOR HAVE LESS STRESS: A recent survey by Edelman Financial Engines suggests that Americans who use a financial advisor are less stressed than those who do not, but that the perceived price of advice is a deterrent to many (even those with significant assets)

WHERE ARE YOU GETTING YOUR NEWS? Your views about the health of the economy may be entirely predicated on the source of your national news. A recent survey demonstrated 85% of those watching Fox News believe a recession is imminent, while less than 20% of those watching CNN and MSNBC believe we are nearing a recession.

PEOPLE ARE SPENDING: In the third quarter of 2022, credit card balances jump 15% year-over-year. The largest increase in more than 20 years. Meanwhile, the personal savings rate plummeted to 2.3%, the second lowest on record, as inflation squeezes consumers.

BE PATIENT: In the 10 prior bear markets (1950-2021), the average length of time it took the S&P 500 to retrace its steps to a new closing high was 25 ½ months. The quickest recovery was just three months (1982), while the longest recovery took 70 months (1974-1980).

VOTERS: In the 2020 presidential election, the 159.8 million voters and the 66.8% turnout were both all-time US records over the past 120 years (NBC News).

What We’re Reading

Help Wanted: CEO of Twitter (Satirical Job Posting) | Jack Hough of Barrons

Thinly profitable microblog seeks masochist for the role of nominal chief executive. Must share owner’s core beliefs, which can last for hours, while accepting blame for both a nascent advertising recession and the world’s broader decline into bitter incivility. Responsibilities include saying some stuff about free speech while quietly begging sponsors to return. Candidates should be willing to commit to a three-month tenure, tops, before a highly public firing that will make Bob Chapek’s ousting at Disney look like the Kennedy Center Honors.

How to Invest | David Rubenstein

This book isn’t a guide for everyday investors wondering how to plan for their retirement. David Rubenstein – a prominent investor himself – delves into the backstories of 20 Wall Street luminaries. Rubenstein puts his subjects at ease, leading to some valuable insights into how the wealthiest investors view their craft.

General Wellness Articles from the Wall Street Journal

How to Make Education an Investment After College | WSJ

Treat your brain, challenge yourself, and stay engaged throughout your life.

Your 401(k) Isn’t Enough: To Invest for Retirement, Build Friendships and Hobbies | WSJ

Retire with purpose, and you may find true bliss in your retirement years.